Contractors in building and construction

Contractors are common in the building and construction industry.

Businesses and people who engage contractors should understand the laws that apply before engaging them.

On this page:

- Follow the rules and avoid the risks

- Contractors and employees in building and construction

- Contractor or employee?

- Contractor test

- Common myths about contractors

- Case studies for contractors in building and construction

- Help for contractors

- Help for businesses

- Tools and resources

- Related information

Follow the rules and avoid the risks

Follow the rules and avoid the risks

It’s critical that businesses know when and how laws apply when engaging contractors.

Follow the advice and tips on this page to stay compliant and avoid legal risks.

We recommend businesses:

- read our information to help understand the difference between contractors and employees

- review their use of contractors and determine if any contractors would be considered employees under the definition of employment in the Fair Work Act that applies from 26 August 2024

- use our free tools and resources to help manage new and existing contracting or employment arrangements.

If businesses have more questions or need specific advice, we recommend they seek legal help.

Contractors and employees in building and construction

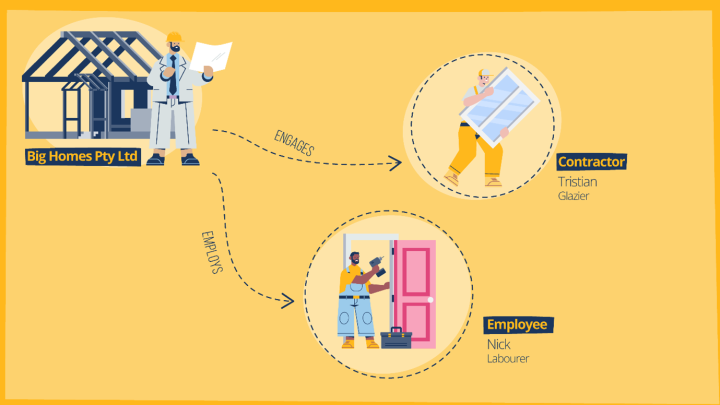

Both contractors and employees can work in building and construction, but different rights, entitlements and protections will apply to them.

Contractors

Contractors provide services to another person or business. They aren’t employed by that person or business.

Contractors can work for:

- themselves (also known as a sole trader) – for example, a bricklayer

- their own business – for example, a scaffolding company.

Apprentices and trainees

Apprentices and trainees can’t be contractors. They must be employees.

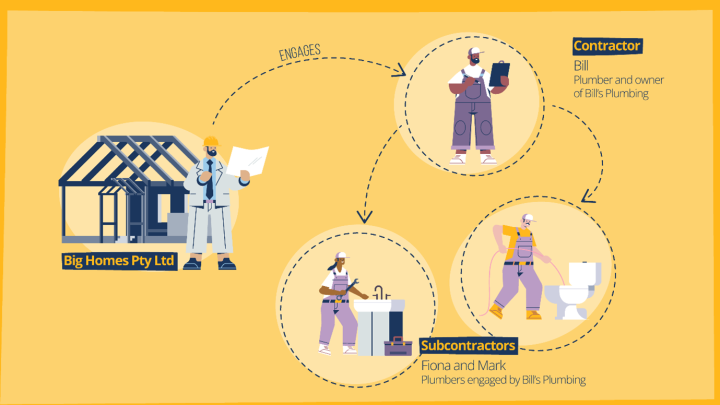

Subcontractors

Contractors may be able to hire other contractors to work for them. These other contractors are called subcontractors or subbies.

Subcontractors have the same legal protections as other contractors. This includes protection from adverse action and the right to belong (or not belong) to an industrial association, like a union.

Employees

Employees are people employed to provide labour to a business in exchange for money. They can be employed on a full-time, part-time or casual basis.

An employee gets minimum workplace entitlements under the National Employment Standards (NES), such as paid time off and public holidays. Awards and agreements will also provide for other entitlements. Learn more from our Employee entitlements in building and construction page.

Some employees aren’t in the national workplace relations system and aren’t covered by the Fair Work Act. This means that their rights and entitlements may come from other laws. Learn who is and isn’t covered in the Fair Work system from our Fair Work system page.

Contractors don’t get these entitlements. This is because they are self-employed and are covered by different laws, including the Independent Contractors Act 2006 .

For more information about the difference between contractors and employees, visit our Independent contractors page.

Residential building industry

Workers in the residential building industry can be contractors or employees. There’s no requirement for a worker on a residential building site to be a contractor.

Residential building work sites may have fewer workers and smaller teams.

There may be chains of contractors on residential sites, with some contractors engaging other contractors or employees. For example, a:

- builder engaging a carpentry company as a contractor

- carpentry company engaging a carpenter as a subcontractor

- carpenter engaging an apprentice as an employee.

The working environment on residential sites may be different to commercial building sites, but the general rules about whether a worker is a contractor or an employee are the same.

Contractor or employee?

A contractor is different to an employee and has a different kind of relationship with the business that engages them.

Contractors provide services to another business and charge a fee. For example, a builder could engage a concreter who has their own concreting business to lay concrete.

Contractors also aren’t covered by an award or registered agreement. They usually negotiate their own fees and working arrangements and can work for more than one client at a time.

Employees are employed by and work for a business and have certain minimum entitlements of employment.

Employees in the building and construction industry are generally covered by an award or registered agreement. These are legal documents that set out their minimum entitlements, such as pay rates, breaks and allowances. Learn more at Understanding the building and construction industry.

There are also no restrictions on the kind of work a contractor can do compared to an employee.

Understand the differences

There are key differences between contractors and employees, including in the building and construction sector.

Our information is a guide

Our information is a guide

The information in our table is a guide.

To determine if someone is a contractor or an employee, certain factors must be considered. These include:

- the terms of the contract

- for most people, how the contract works in practice.

Our table below provides common examples of these factors in the building and construction industry.

It shouldn’t solely be used to make decisions about if a specific worker is a contractor or an employee.

Make sure you read our How to confirm if someone is a contractor section as well.

Table: Differences between a contractor and employee in residential building industry

The table below uses the example of the residential building industry to show common characteristics of a contractor and an employee:

| What the work looks like | Contractor | Employee |

|---|---|---|

| How they’re engaged |

|

|

| Where the entitlements come from |

|

|

| Pay and conditions |

|

|

| Control over work |

|

|

| Risk and responsibility |

|

|

| When work is performed |

|

|

| Tools and equipment |

|

|

| Ongoing work |

|

|

| Engaging other workers |

|

|

Contractor test

There are different tests that need to be applied to determine if a person is a contractor or an employee.

The test used depends on the kind of business and where it’s based.

Below is a summary of the different tests that may be used to determine if a person is a contractor or an employee. Find more detailed information on the different tests in our Independent contractors section.

Using the right test

It’s important for businesses and workers to know which laws apply to them. This will help determine what kind of test they have to use.

A business must use the whole of relationship test to determine if a worker is a contractor or an employee from 26 August 2024 if they’re:

- a company, usually with PTY LTD or LTD at the end of the name, or

- a sole trader or partnership based in the Australian Capital Territory or the Northern Territory.

These businesses are called constitutionally covered businesses.

A business must use the start of relationship test if they’re a sole trader or partnership based in:

- New South Wales

- Queensland

- South Australia

- Tasmania, or

- Victoria.

These businesses are called state referred businesses.

Constitutionally covered businesses also use the start of relationship test to determine if a worker was a contractor or an employee before 26 August 2024.

Other rules may also apply to state referred businesses. Understand these rules by going to our State referred national system businesses page.

If the business is a sole trader or partnership based in Western Australia (WA), they may not be in the national workplace relations system. This means that the Fair Work Act may not fully apply to them. Contact the WA workplace authority for help and advice: Department of Energy, Mines, Industry Regulation and Safety.

Whole of relationship test

The whole of relationship test is one test used to determine if a worker is a contractor or an employee from 26 August 2024.

When using the whole of relationship test to check if there’s an employment relationship between a business and a worker, consider:

- the real substance, practical reality and true nature of the relationship

- all parts of the relationship between the parties, including the terms of the contract and how the contract is performed in practice.

This means considering the whole relationship and not just the terms of the contract.

There are several factors that, when considered together, can help you determine the difference between a contractor and an employee.

Read more about these factors on our Whole of relationship test page.

A person who earns above the contractor high income threshold can choose to opt out of using the whole of relationship test and use the start of relationship test instead.

Learn more at Opting out of the whole of relationship test.

Start of relationship test

The start of relationship test is used by:

- state referred businesses

- constitutionally covered businesses when determining if a worker is a contractor or an employee:

- before 26 August 2024, or

- if the worker has opted out of the whole relationship test.

For the start of relationship test, whether a worker is a contractor or an employee will depend on what was agreed at the start, or before the start, of the relationship. This will usually be in the form of a contract, which can be:

- written

- verbal, or

- a mix of both.

Tip: It’s best to have contracts in writing

You can have a contract that’s verbal but it’s best practice to have contracts in writing.

Written contracts help protect businesses and workers by making sure everyone is clear about the terms of the contract.

Changes made after the relationship starts won’t usually be relevant in determining the nature of the relationship.

When considering what was agreed at the start, or before the start, of the relationship, several factors can help to determine the difference between a contractor and an employee.

Read about these factors on our Start of relationship test page.

Common myths about contractors

Below are some common myths corrected about contractors:

- Being called a ‘contractor’ makes you a contractor

- Some employees have an ABN to work

- Contractors don’t always have control over their work

- Contracts must always be in in writing

Being called a ‘contractor’ makes you a contractor

Having a contract – written or verbal – that says you’re a contractor doesn’t mean you’re automatically a contractor.

If your relationship with a business meets the criteria of an employment relationship, using the appropriate test, you’re legally an employee. In many cases, being called a ‘contractor’ in a contract (particularly a written one) won’t change this.

A business also can’t just decide to treat you as a contractor. You must agree to be a contractor as well as to the terms of your engagement with the business.

Some employees need an ABN to work

An ABN is a unique number that identifies a business to the government and other businesses. Employees don’t typically need an ABN.

You’re only required to get an ABN if you genuinely want to become a contractor or start your own business.

If a business requires you to get an ABN but says you’re an ‘employee’, be careful of these offers. This may be a way for a business to lower their costs by engaging ‘contractors’ but treating them like employees.

Just because others in your industry have ABNs doesn’t mean you need one.

Contractors don’t always have control over their work

Contractors usually have control of how they perform their work, including if they can delegate or subcontract their work to others. Contractors can also have more freedom about their hours of work and where they work.

If a contractor doesn’t have control over their work, this may be an indicator that they’re not a contractor and are actually an employee.

Contracts must always be in in writing

A contract doesn’t need to be in writing. If someone has verbally made an agreement, this can be considered a contract.

Even if you entered into a contract (verbal or written) with a business and it says you’re a contractor, this may not reflect the true nature of the relationship. You could still be an employee.

Case studies for contractors in building and construction

Our case studies provide practical guidance on the following scenarios:

- a business proactively reviews their contractors against the new definition of employment

- a person is engaged as an independent contractor when they should have been an employee and demonstrates what outcomes could arise depending on the businesses response

- an example of a genuine contractor.

Visit Case studies for contractors in building and construction.

Help for contractors

Under workplace laws, contractors have specific rights and protections.

Protections at work

Contractors are protected under the Fair Work Act from:

- adverse action

- coercion

- abuses of freedom of association.

Learn more at Protections at work.

Disputes about if someone is a contractor

Determining if someone is a contractor or an employee can be complex. Each situation will be different and it will be determined by the circumstances of each arrangement.

In some situations, a court may need to determine the nature of the relationship. If it’s not immediately clear if someone is a contractor or an employee, it may be best to seek legal advice. Find organisations that may be able to help from our Legal help page.

Disputes about payment

Contractors usually get paid through invoices. If a contractor doesn’t get paid, they can take legal action or seek legal advice. We (the Fair Work Ombudsman) can’t enforce payment of unpaid invoices.

Contractors can contact the Australian Small Business and Family Enterprise Ombudsman (ASBFEO) for assistance. The ASBFEO provides free access to dispute resolution information and services.

There are also state and territory laws to help contractors resolve payment disputes in the building and construction industry. Find your relevant agency from Security of payment.

Unfair contracts

Contractors who believe they have unfair terms in their contract can get help through different pathways. For more information, visit Contractor entitlements and support.

Sham contracting

It’s illegal for a person or business to represent to a worker that their relationship is a contracting arrangement rather than an employment relationship when the person or business doesn’t reasonably believe this. This is called sham contracting.

It’s also illegal to:

- knowingly say something false to convince an employee to become a contractor to do the same work (or mostly the same work), or

- dismiss or threaten to dismiss an employee to engage them as a contractor to do the same work (or mostly the same work).

If you’re currently being treated as a contractor but think you’re performing work as an employee, you should read our Sham contracting page. We provide advice on what to do next and where to seek help.

Other help

There are other government agencies and industry organisations that can help with issues in the building and construction industry. For information and referrals, visit our Other help available page.

Help for businesses

Businesses may engage employees, contractors or both.

If you’re not sure if a worker should be a contractor or an employee, we recommend you:

- consider what you need the worker for and what relationship you will have with them

- review the information in our Independent contractors section

- access our free resources to help you understand what applies.

Hiring employees

Want to hire an employee? If you’re sure you want to hire an employee, we encourage you to:

- visit our Hiring employees page

- read our Understanding the building and construction industry page

- use the business.gov.au Hiring employees checklist.

Engaging contractors

Want to engage a contractor? We recommend you visit:

- business.gov.au’s Contractor rights and protections page

- our Managing your labour contracting page and follow our 5 steps.

Tip: Use a free tool to create a contract

Tip: Use a free tool to create a contract

business.gov.au has free tools to help you build a contract relevant to your relationship to a potential worker.

Hiring an employee? Build a free contract for your employee with the Employment Contract Tool.

Need help with engaging a contractor? Access the free How to prepare a contract guide. It will give you free tips and advice on how to prepare a lawful contract.

Source references: Fair Work Act ss 15AA and Independent Contractors Act 2006

Tools and resources

Tools and resources

- business.gov.au Employment Contract Tool

- business.gov.au How to prepare a contract guide

- business.gov.au Contractor rights and protections

- Guide to labour contractingGuide to labour contracting

Related information

Related information